The Essential Guide to Supplemental Cargo Insurance: Why Shippers Need More Than Carrier Liability

Every shipment carries inherent risks. From theft to unexpected weather conditions, cargo loss or damage is a constant concern in the logistics industry. Many shippers rely solely on standard carrier liability, but this coverage often falls short, particularly for high-value or sensitive freight. Supplemental cargo insurance bridges the gap, offering comprehensive protection beyond the limited coverage of carrier liability.

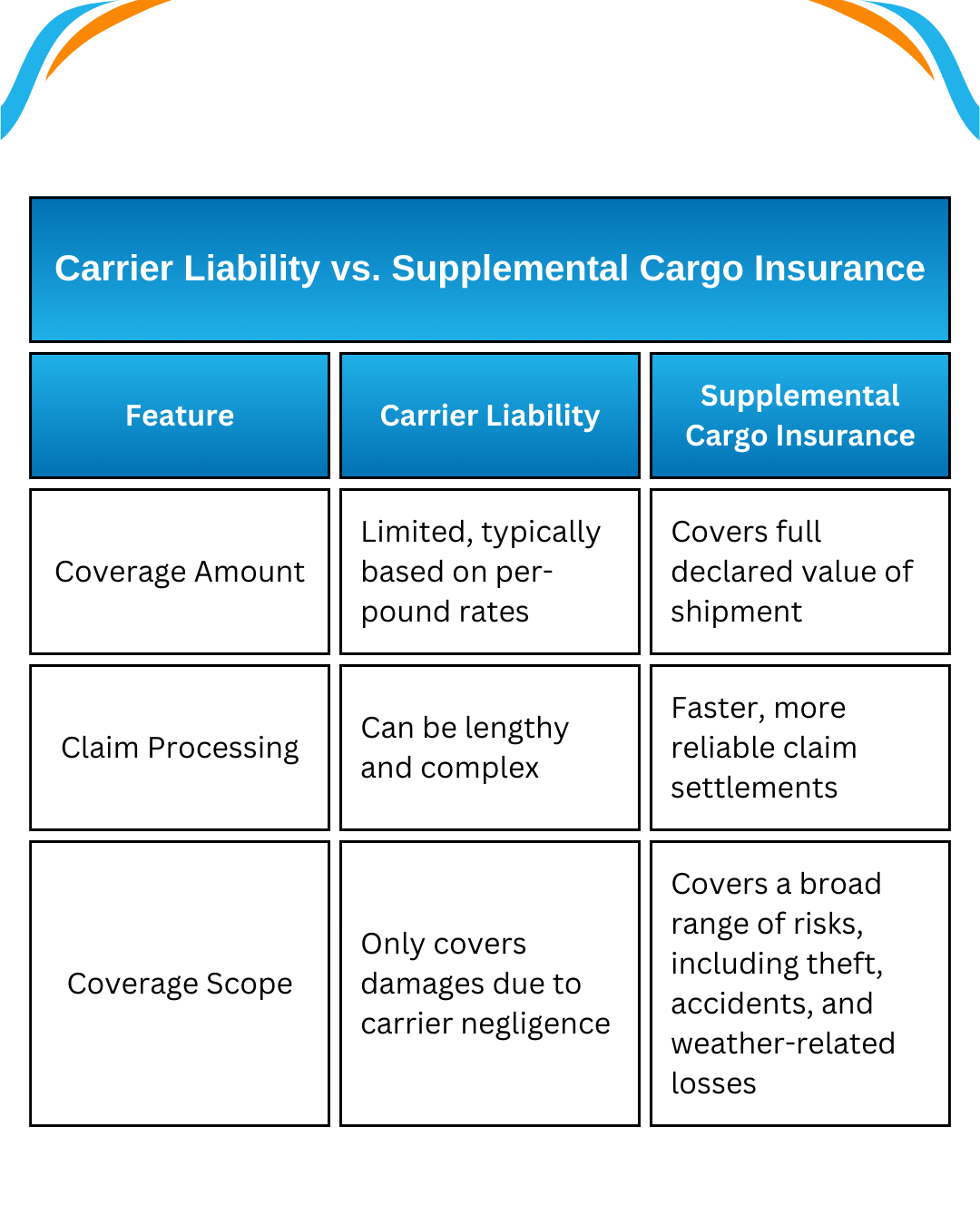

Carrier Liability vs. Supplemental Cargo Insurance

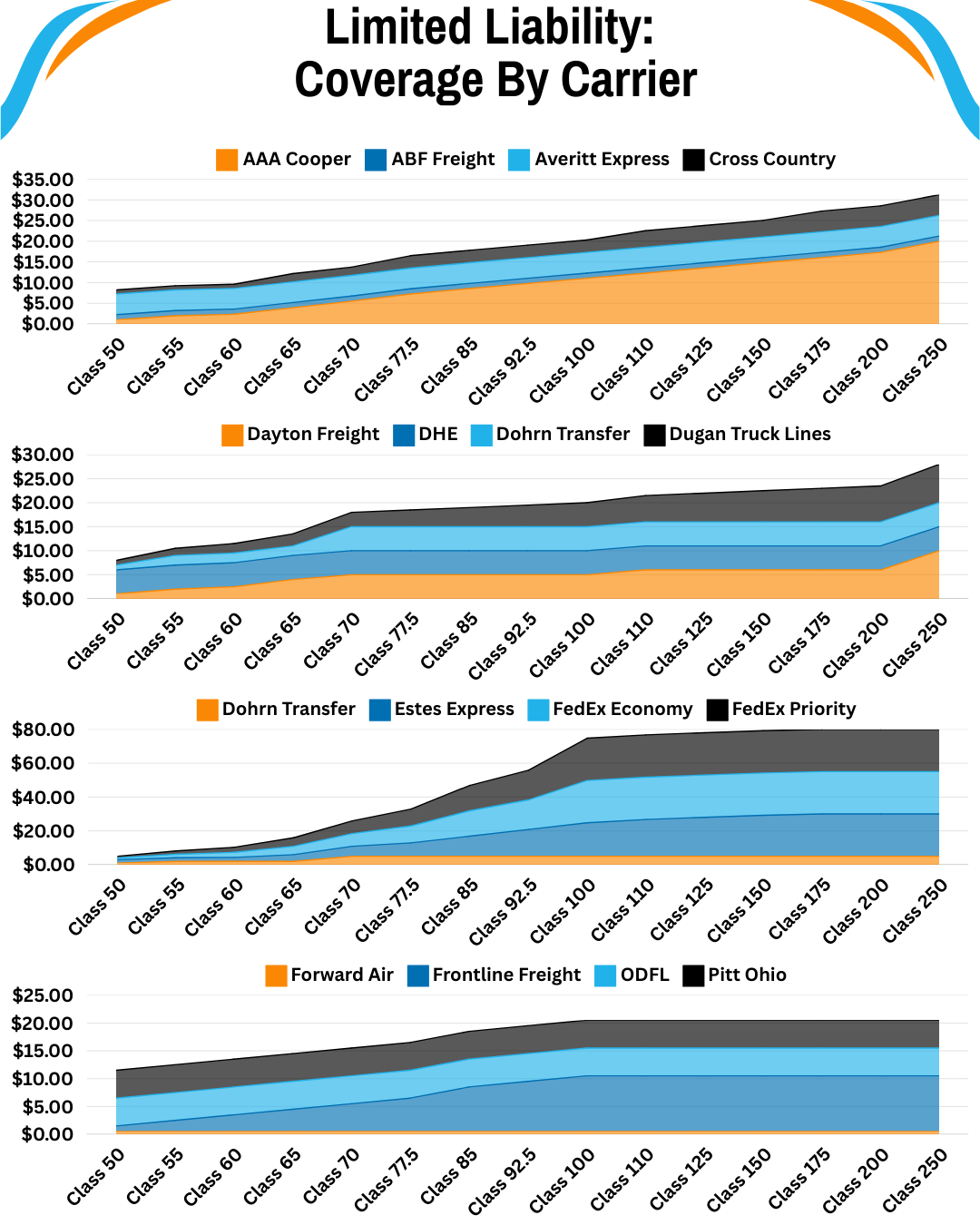

It’s a common misconception that carrier liability provides adequate protection for shipments. In reality, standard policies typically offer minimal coverage based on shipment weight rather than actual value. Here’s how carrier liability compares to supplemental cargo insurance:

Key Takeaway:

Carrier liability is not true insurance—it only covers carrier fault and is often insufficient. Shippers transporting valuable or sensitive cargo should invest in supplemental coverage.

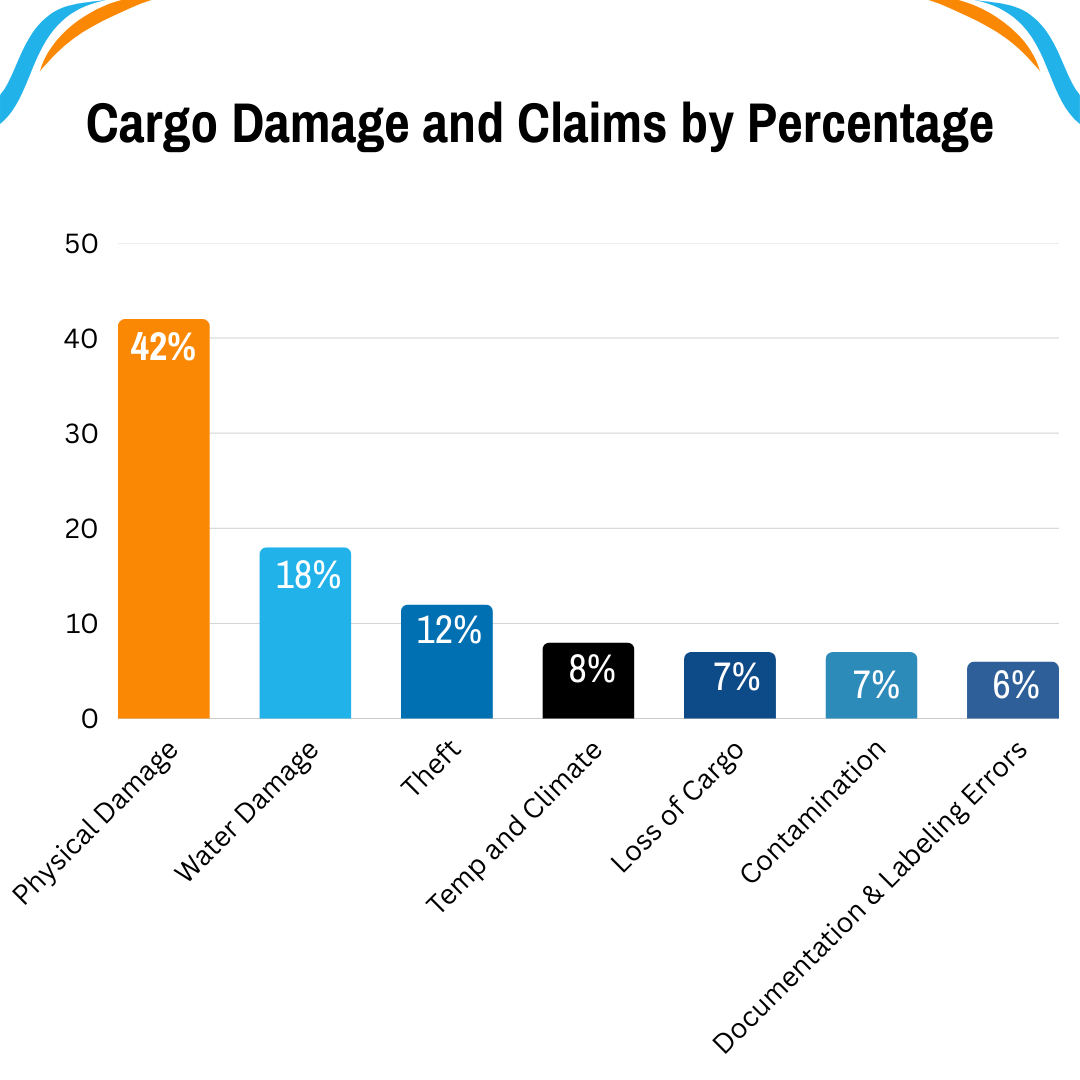

Common Cargo Risks and the Need for Extra Protection

Even with meticulous planning, unexpected disruptions can jeopardize shipments. Here are the top causes of cargo damage and loss:

1. Theft and Hijacking

Organized theft rings frequently target high-value goods such as electronics and pharmaceuticals.

2. Weather-Related Damage

Storms, flooding, and extreme temperatures can wreak havoc on unprotected freight.

3. Mishandling and Accidents

Human error or vehicle collisions during transit can result in damaged goods.

4. Customs Delays and Inspections

International shipments are particularly vulnerable to damage or delays during customs inspections.

Did You Know?

Over $30 billion worth of cargo theft occurs annually in the U.S. alone. Can your business afford the risk?

How Does Supplemental Cargo Insurance Work?

Unlike carrier liability, supplemental cargo insurance provides full-value protection for shipments. Here’s how it typically works:

- Shipper Declares Value The shipper specifies the actual worth of the cargo before transit.

- The policy is Issued The shipment is insured for its declared value against covered risks.

- Incident Occurs In the event of damage or loss, a claim is filed directly with the insurer, bypassing the carrier.

- The claim is Processed Payouts are quicker and more reliable compared to disputes under carrier liability.

Key Takeaway:

Supplemental insurance simplifies the claims process and protects against more risks than basic carrier liability.

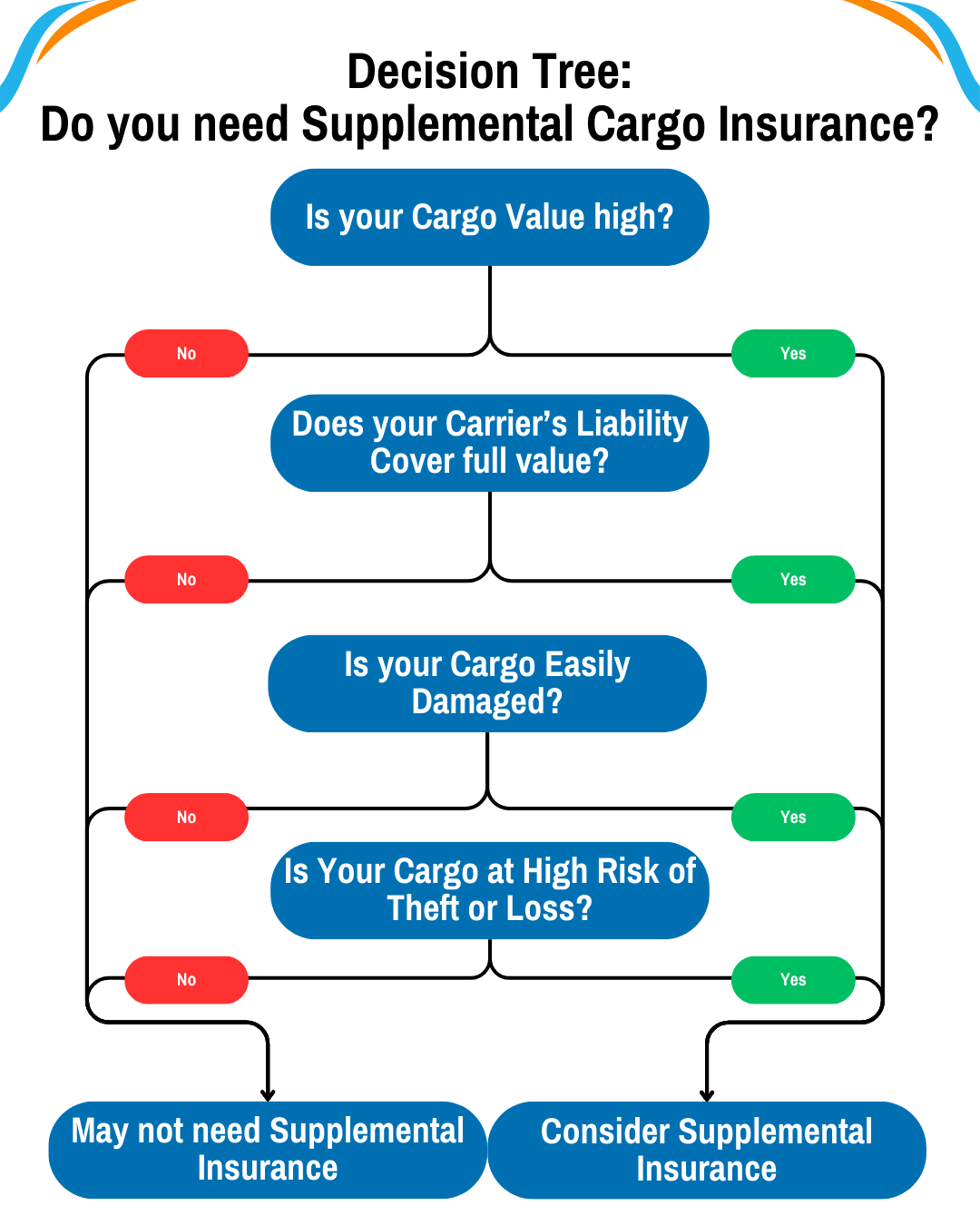

Who Should Invest in Supplemental Cargo Insurance?

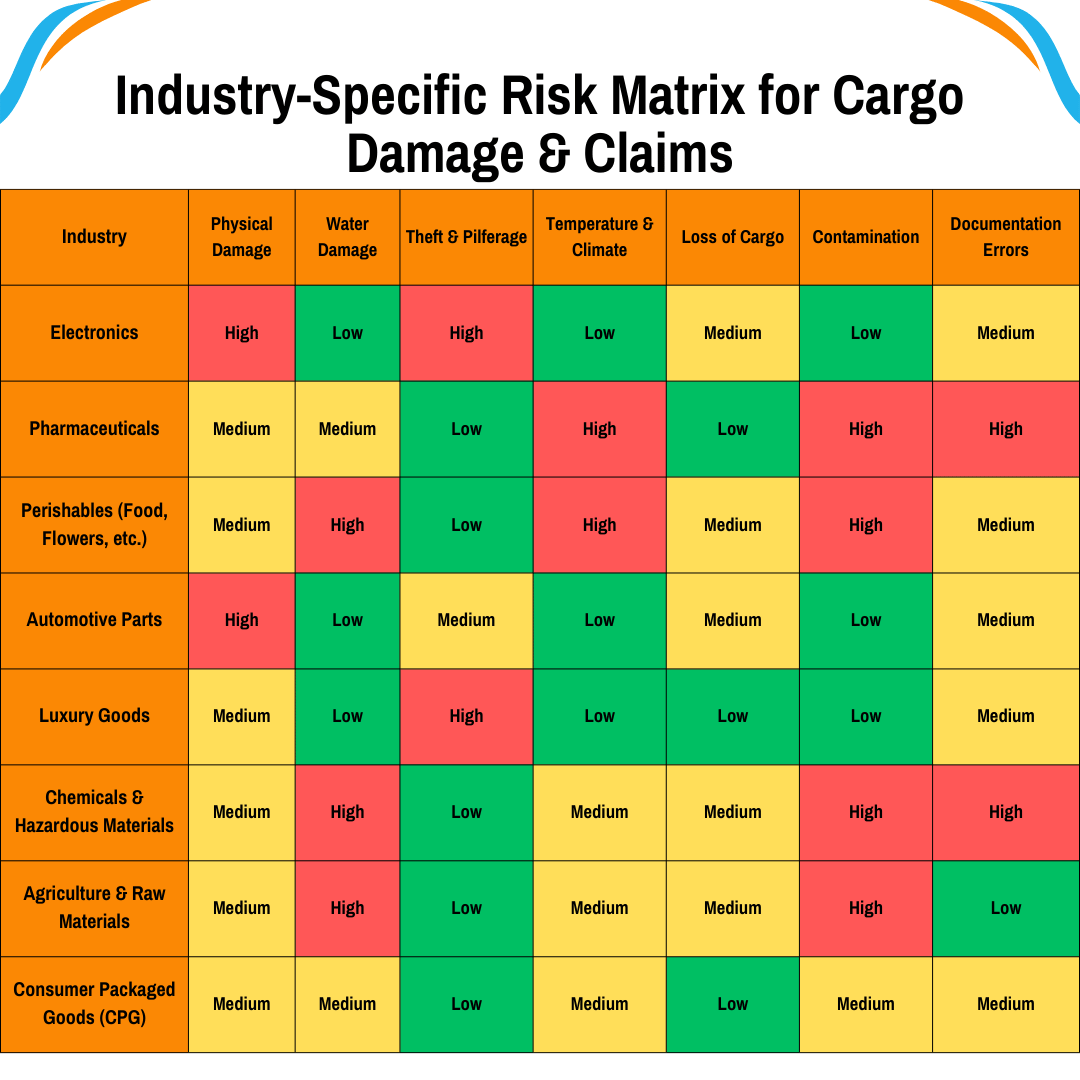

Not every shipment requires full coverage, but industries with higher risks should strongly consider it:

- Electronics and Technology: High theft risk; expensive to replace.

- Pharmaceuticals and Healthcare: Requires temperature control and safe handling.

- Agriculture and Perishables: Prone to spoilage, contamination, and delays.

- Luxury Goods and Retail: High-value items with long supply chains.

Cost vs. Risk: Is Supplemental Cargo Insurance Worth It?

While some shippers hesitate due to cost concerns, a small premium upfront can save thousands in potential losses.

Example Scenario:

A shipper sends $50,000 worth of electronics via an LTL carrier. The shipment is damaged during transit. Under carrier liability, the reimbursement is based on a standard $0.50 per pound rate, resulting in only $2,500 in coverage. This leaves the shipper with a $47,500 loss. With supplemental insurance, they would be reimbursed for the full declared value of $50,000.

Final Thought:

If you can’t afford to lose it, you can’t afford to ship it without full coverage.

How to Choose the Right Cargo Insurance Policy

When selecting a policy, consider the following:

- Coverage Limits and Exclusions Does it cover risks like theft, natural disasters, or spoilage?

- Claim Processing Time How quickly can you recover losses in the event of an incident?

- Cost vs. Shipment Value Is the premium justified by the protection it offers?

- Industry-Specific Needs Does your cargo require specialized coverage?

Final Takeaway: Protect Your Shipments, Protect Your Business

Supplemental cargo insurance is more than an added expense; it’s an investment in reliability and financial security. While carrier liability offers limited protection, supplemental insurance ensures peace of mind for shippers handling high-value, perishable, or time-sensitive goods. We’ve got your back—reach out if you need help finding the right coverage to keep your cargo secure!